By: Inma Hernandez, Associate Professor, UCSD

After the passage of the Inflation Reduction Act, Medicare will finally be able to negotiate drug prices in 2026. Medicare will negotiate prices for 10 top-spending Part D drugs in 2026, 15 Part D drugs for 2027, and 15 Part B or D drugs in 2028. If you have been wondering which drugs will face negotiation, our study published earlier this week in JMCP has answers for you.

In 2026-2028, the first 3 years of price negotiations, Medicare will likely negotiate prices for 38 Part D & 2 Part B drugs, including 7 inhalers, 8 anti-diabetics, 5 TKIs, and 3 DOACs. Combined, these 40 drugs accounted for $67.4 billion in gross Medicare spending in 2020.

In 2026, direct oral anticoagulants Eliquis and Xarelto, antidiabetics Januvia and Jardiance, inhalers Symbicort and Breo Ellipta, tyrosine kinase inhibitors Imbruvica and Ibrance, TNF inhibitor Enbrel and anti-androgen Xtandi will become the first 10 drugs to face negotiation.

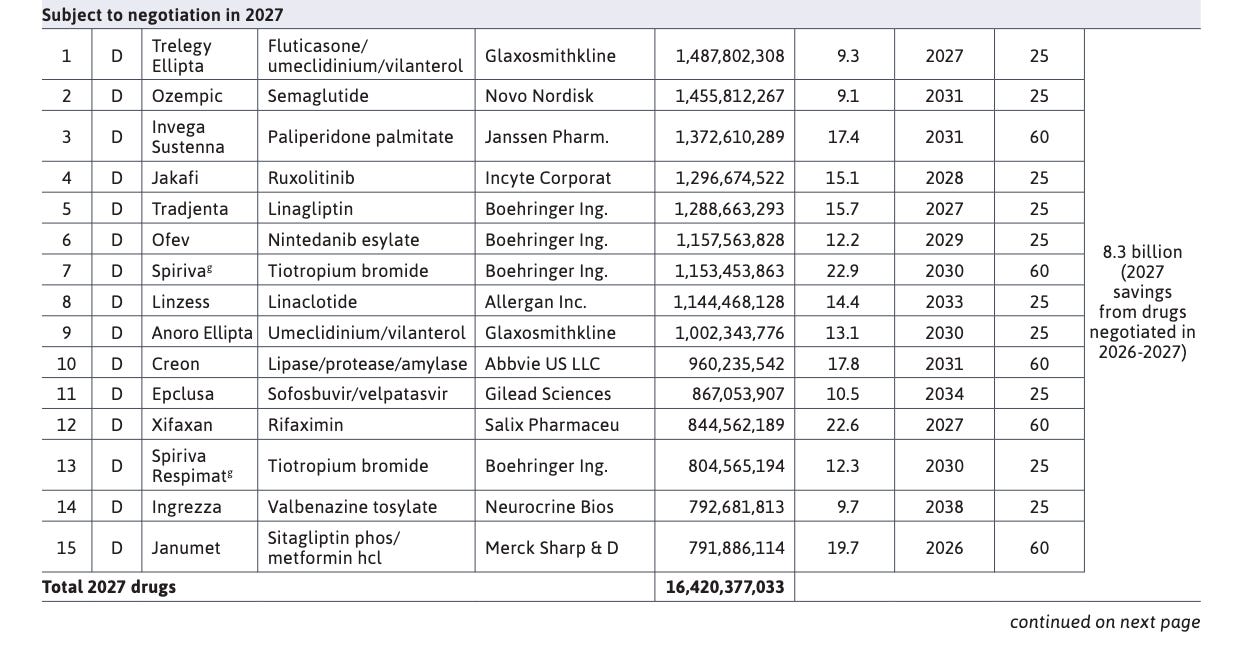

In 2027, four additional inhalers, three antidiabetics (including Ozempic), two kinase inhibitors, antipsychotic Invega Sustenna, hepatitis C treatment Epclusa, IBS therapy Linzess, pancreatic enzyme mix Creon, antibiotic Xifaxan, and tardive dyskinesia therapy Ingrezza will join the list of drugs negotiated.

In 2028 Part B drugs will become eligible for negotiation, however, only 2 drugs are expected to actually make the list: Opdivo and Keytruda. Other high-spending Part B drugs will be ineligible for negotiation as they are expected to face generic or biosimilar entry by then. Among the remaining 13 Part D drugs, there are three additional antidiabetics and four antivirals.

Negotiated prices will remain in effect until the drug becomes ineligible because of generic or biosimilar competition. It is expected that 2028 will be the first year when this happens, as Januvia and Janumet will be no longer eligible for negotiated prices due to generic competition.

The predictions are based on 2020 Medicare drug spending and on the information available on patent expiration and settlement dates available at the time of the study.

As drug utilization changes over time, it is likely that the rank of drugs eligible for negotiation will change. For a drug to be ineligible for negotiation due to generic or biosimilar competition, the generic or biosimilar needs to be not only approved but also marketed. This is the reason why Symbicort remains eligible got negotiation, as it has an approved generic that yet has not being launched.